[powerpress]*Note: The ‘meat’ of this episode starts at 15 mins in the video.

The Single Best Way to Start Screening & Ranking ICOs

Initial Coin Offerings, otherwise known as ICOs are more popular than ever before.

They are the new IPOs…. In fact many are much bigger than IPOs.

ICOs represent the biggest shift in capital compared to anything we have recently seen…

…and the trend is only growing.

Currently, if you invest in the right ICOs, you have a high likelihood that you’ll make a significant profit.

But how do you choose the right ICO to invest in? That is the tricky part.

There are many ways to choose a good ICO…

…and in this post, I’m going to show you how to select ONLY the best ICOs – that will outperform all others.

There an actual formula that I’ve created to show you exactly how this is done.

This is the key.

I’m going to show you the first step in this process. However, first things first…. You need to understand sentiment analysis.

What is Sentiment Analysis?

Sentiment analysis is a way to look at large sets of contextual data to understand if the data has a positive or negative sentiment or tone to it. By analyzing text based data, sentiment analysis allows you to determine if the text leans to a positive perception or a negative perception of the topic analyzed.

This is how Wikipedia defines it:

Sentiment analysis (sometimes known as opinion mining or emotion AI) refers to the use of natural language processing, text analysis, computational linguistics, and biometrics to systematically identify, extract, quantify, and study affective states and subjective information. Sentiment analysis is widely applied to voice of the customer materials such as reviews and survey responses, online and social media, and healthcare materials for applications that range from marketing to customer service to clinical medicine.

Generally speaking, sentiment analysis aims to determine the attitude of a speaker, writer, or other subject with respect to some topic or the overall contextual polarity or emotional reaction to a document, interaction, or event. The attitude may be a judgment or evaluation (see appraisal theory), affective state (that is to say, the emotional state of the author or speaker), or the intended emotional communication (that is to say, the emotional effect intended by the author or interlocutor).

*Source: https://en.wikipedia.org/wiki/Sentiment_analysis

Wow… this is some powerful stuff.

Here are a few other examples and information about how Sentiment analysis has been used: https://callminer.com/blog/sentiment-analysis-examples-best-practices/

So as you can see this is some cutting edge stuff…

…But does it really matter?

Why is Sentiment Analysis Important When Trading Cryptocurrency?

Sentiment is important in trading, particularly in the crypto world because many of the price increases and price panics are driven by sentiment in the market.

This is an important point.

Investors and traders rely on confidence of a market in order to effectively buy and profit. Sentiment gives investors an edge because they can see the whole picture – how the market is ‘feeling’ about a particular stock or cryptocurrency.

Now… what do you think of that? Still don’t believe that sentiment analysis can help you choose the right ICOs or cryptocurrency to trade?

This is for all you doubters out there…

…a few studies that have been conducted specific to how sentiment analysis has been used to predict the stock market.

- Stock Prediction Using Twitter Sentiment Analysis

- Stock Trend Prediction using News Sentiment Analysis

- Predicting Stock Market Movement Using Sentiment Analysis

It’s important to digest this….

How is it possible that market trends or even individual stock performance is being predicted by sentiment of media channels?

…because humans are predictable. Stock and cryptocurrency price movements swing up or down due to human emotion.

When a panic ensues, traders think they are going to lose all their money and sell….

But first people start talking negatively about the stock or cryptocurrency.

…this all starts online in the blogosheres and twitter-spheres of the internet.

Now that is powerful – and no wonder why many multi-million dollar hedge funds are starting to take a very hard look at sentiment analysis and using it to predict market trends and activity.

Sentiment is a reflection of how people feel about something. Sentiment is trackable. Sentiment is predictable. Sentiment is powerful.

What is an ICO Sentiment Tracker (ICOST)?

The ICO Sentiment Tracker tool is a unique way to analyze initial coin offerings, based on their social signals in the market… based on sentiment analysis.

It’s a tool that I’ve created to help myself figure out which ICOs to invest in.

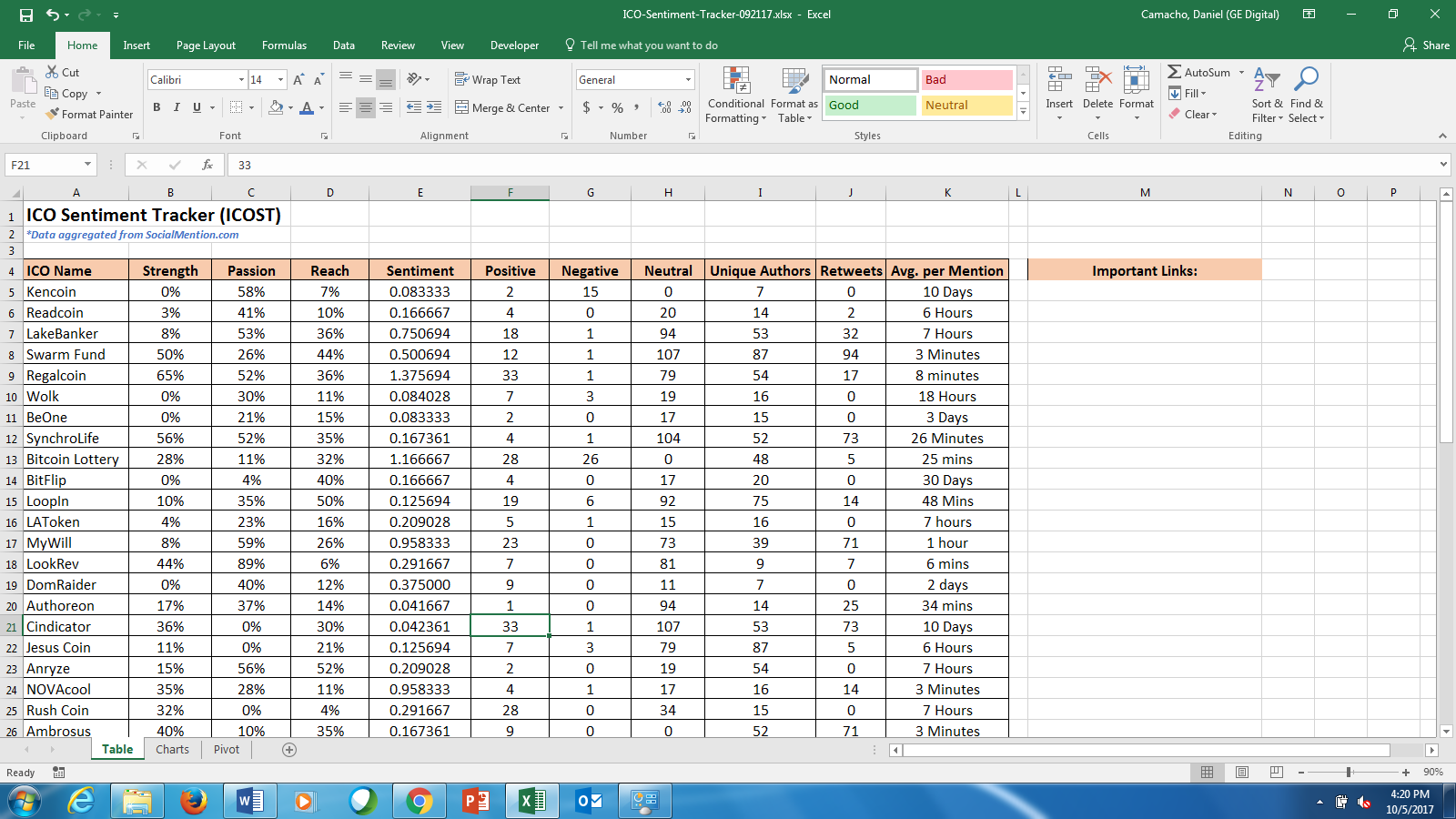

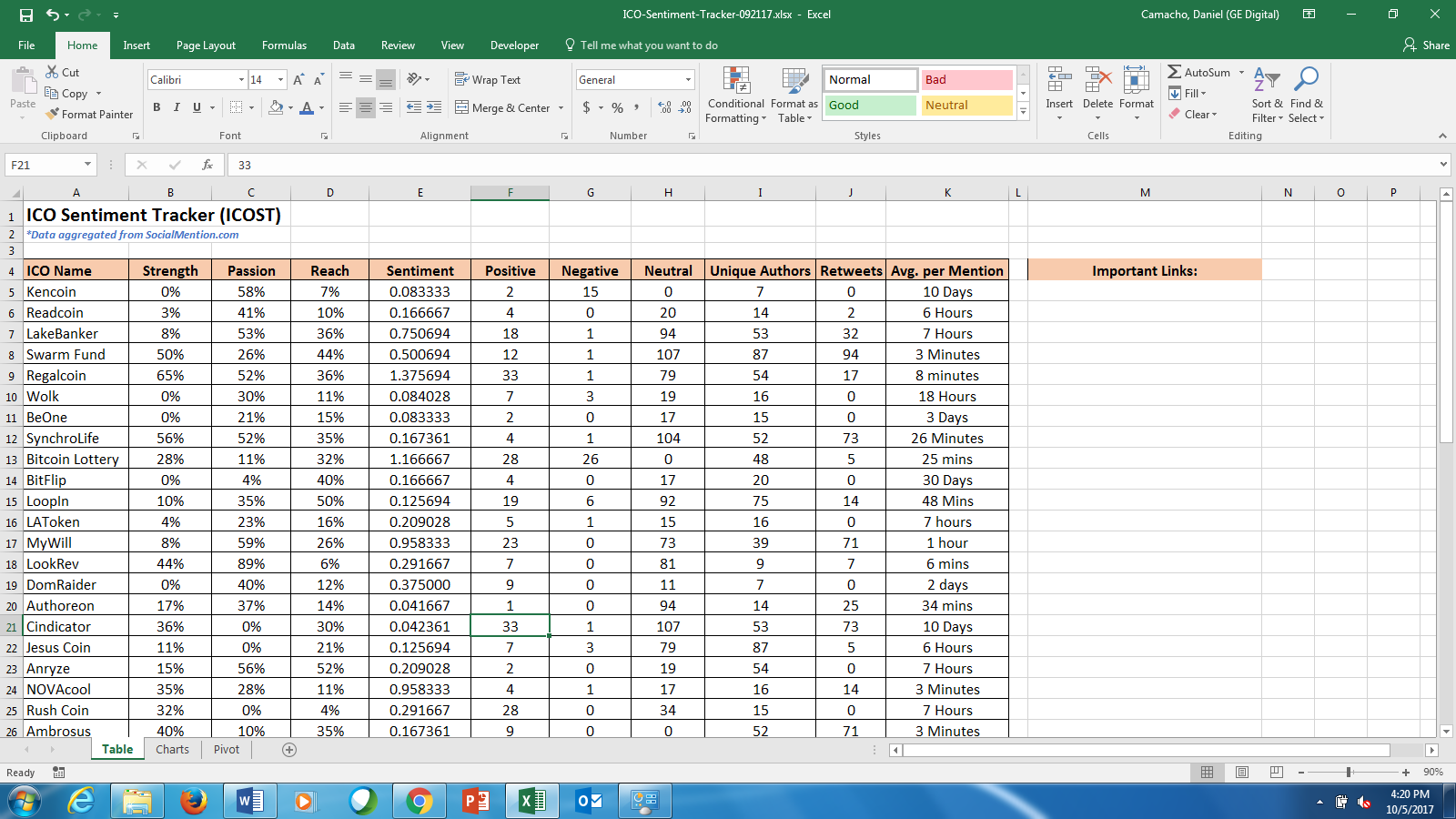

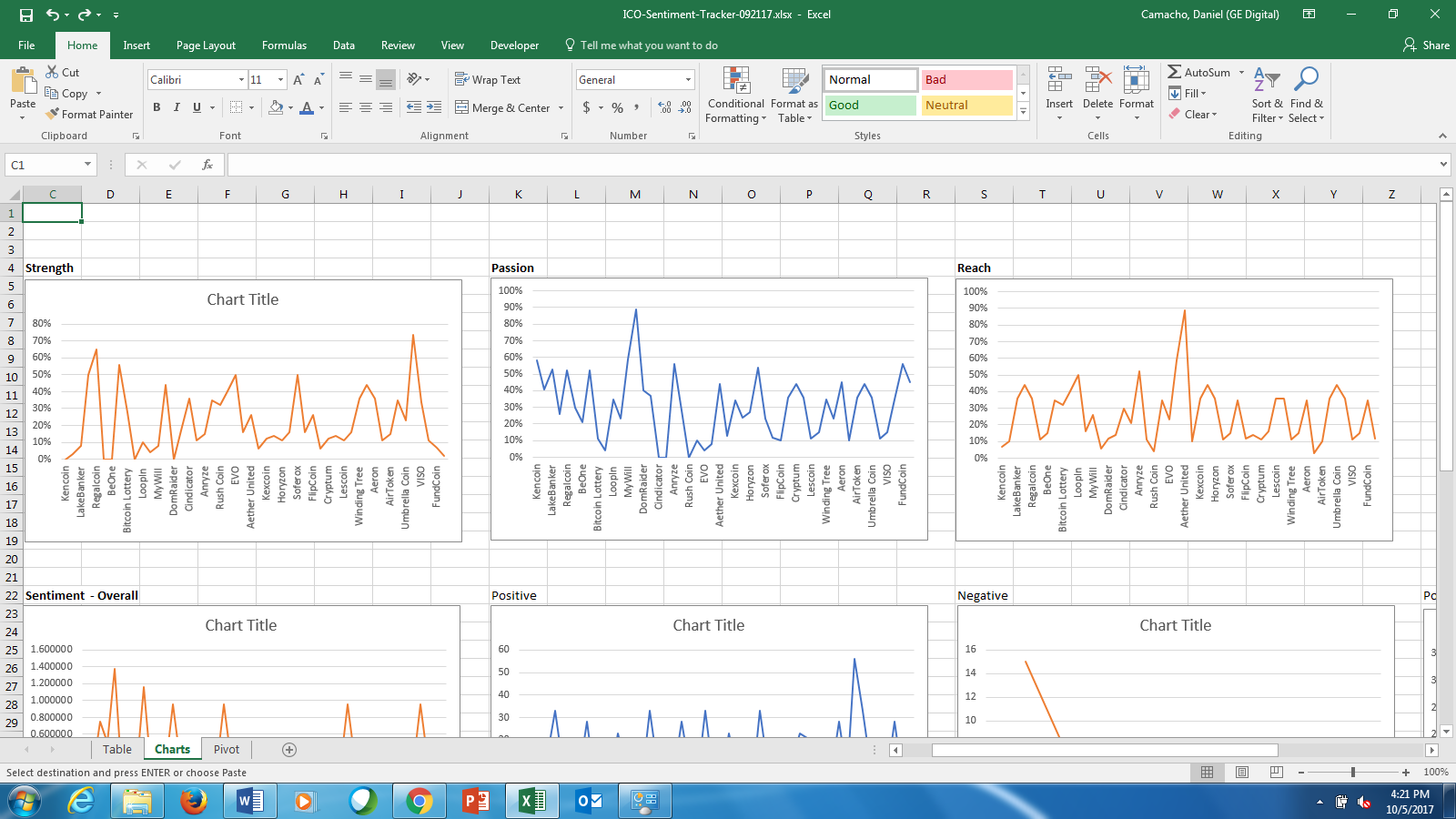

Here is a snapshot of the tool:

Yep, it’s just a spreadsheet…. But not just any spreadsheet. It a categorization of ICOs, ranked by social sentiment signals that indicate the popularity of particular ICOs.

By using free online social sentiment analysis tools, traders can get significant insight into the overall popularity and adoption of an ICO by looking at 4 core signals – Strength, Passion, Sentiment, and Reach.

…This gives a trader a significant edge over the competition.

First, let’s take a moment to define the core signals here:

- Strength: Strength is the likelihood that your brand is being discussed in social media. A very simple calculation is used: phrase mentions within the last 24 hours divided by total possible mentions.

- Sentiment: Sentiment is the ratio of mentions that are generally positive to those that are generally negative.

- Passion: Passion is a measure of the likelihood that individuals talking about your brand will do so repeatedly. For example, if you have a small group of very passionate advocates who talk about your products or brand all the time you will have a higher Passion score. Conversely if every mention is written by a different author you will have a lower score.

- Reach: Reach is a measure of the range of influence. It is the number of unique authors referencing your brand divided by the total number of mentions.

These four core signals indicate whether or not an ICO has enough reach, passion, or strength in the market – and what this implies about the success of an ICO launch.

You can even create nifty little charts to see how each ICO plots on a graph. This enables you to quickly assess and sift though the good from the bad ICOs.

This gives you a very easy way to quickly identify ICOs that may have potential to increase in price (after the ICO launch of course).

Let’s dig in a little more on how this all works….

How Does The ICOST Tool Work?

I built the ICOST tool as a way to help myself better understand how to invest in ICOs. I was **overwhelmed by all the ICOs** out there and thought that there must be an objective way to start ‘filtering’ the hundreds of ICOs I was seeing pop up on a daily basis.

…Where would I even start?

…Which ICO should I Invest in?

…Which ones would be profitable?

…I had so many questions.

So this started to propel my interest to start looking for ways to weed out negative or ‘bad’ ICOs – right out of the gate.

How could I take a huge list of ICOs and immediately remove 50% of the ICOS from the list because they are poor quality? Was there a way for me to qualify the top ICOs and put them aside for secondary research ?

Then it struck me that I could use social sentiment and search trend analysis to start differentiating the ‘good’ ICOs from the ‘bad’ ICOs.

I was stoked…. And super excited to start building something.

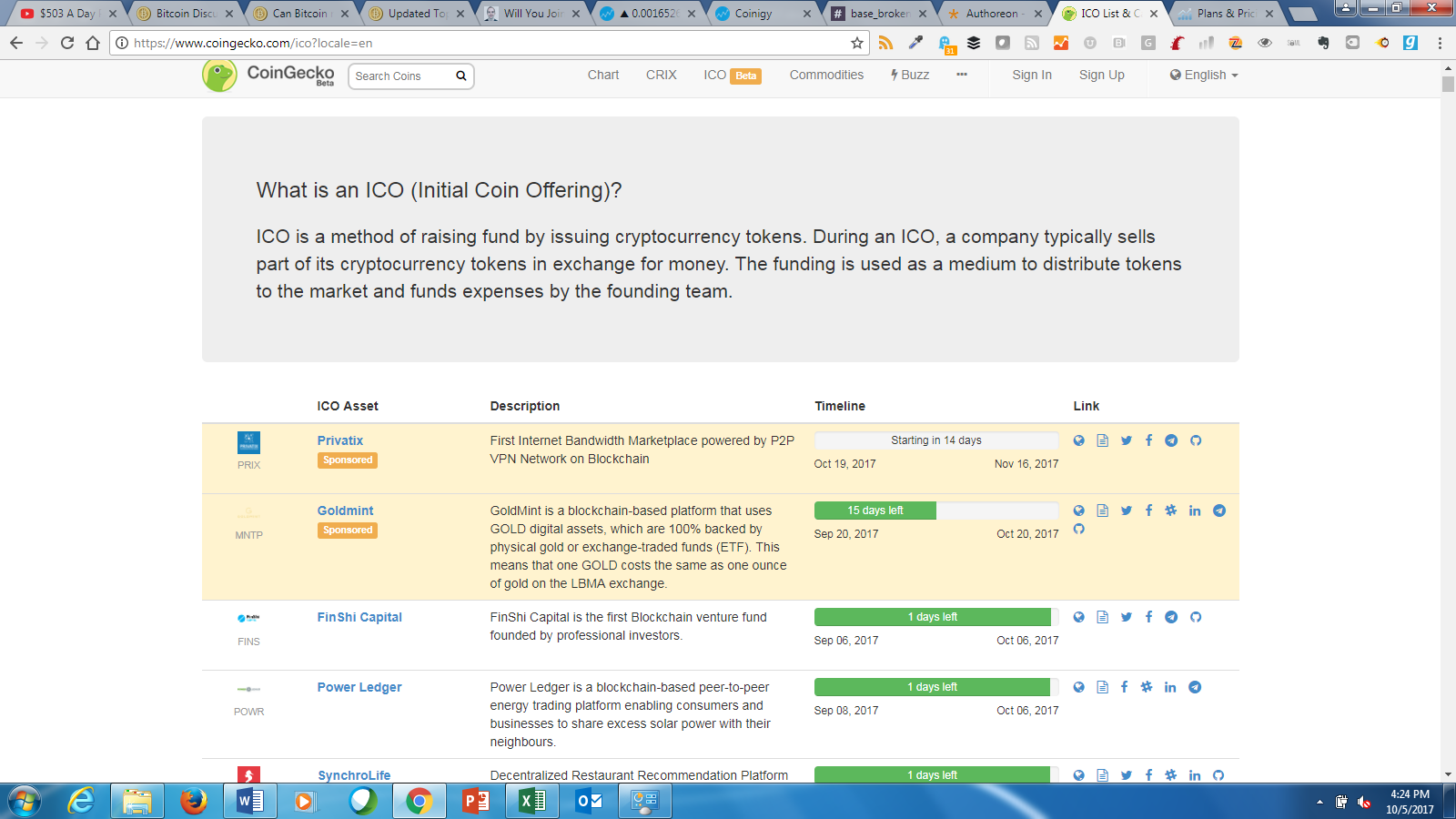

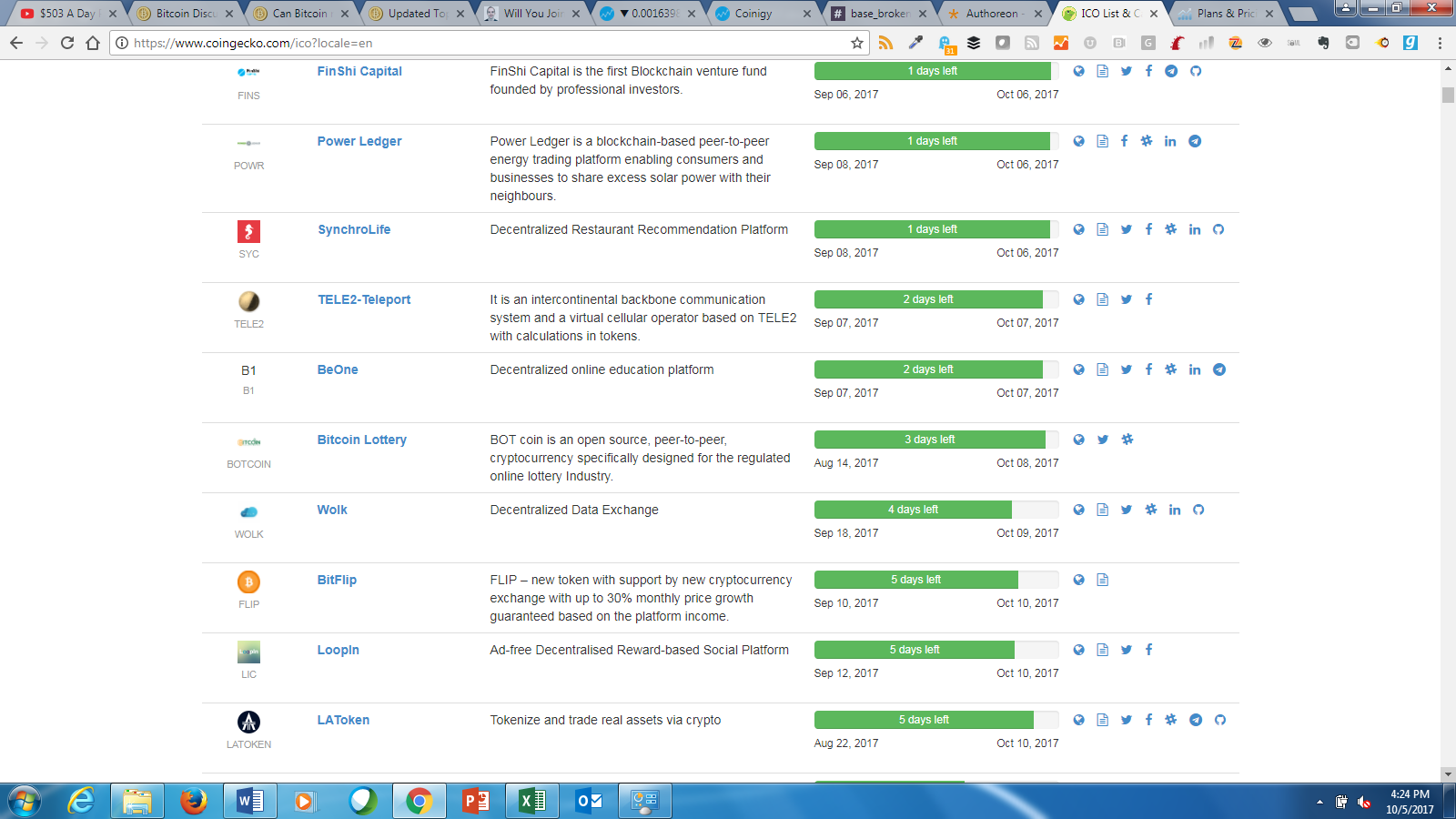

First, I had to find a reliable source of consistent ICO information. I needed to find a list of all upcoming ICOs. For this, I turned to a website called CoinGecko.com . I like CoinGecko because it is simple, clean and a straightforward way to get ICO information – that updates on a regular basis.

Here’s a quick snapshot of how CoinGecko lists out ICOs:

You can also use these sources to track all upcoming ICOs as well:

Now that I had found a reliable place to track upcoming ICOs, I had to find a sentiment analysis tool that was free, easy to use and that gave me good insight based on a keyword search – that was key.

After much digging, I found SocialMention.com – which is a like a search engine for social sentiment.

It was exactly what I was looking for.

Here is a snapshot of the Social Mention interface.

Let’s take a quick look at what signals Social Mention provides.

As mentioned previously, there are 4 core signals that Social Mention provides – Strength, Passion, Sentiment, and Reach.

…This gives a trader a significant edge over the competition.

Additional metrics can also be used to measure and trade off of, but these are the core four metrics I used. Now you see where we’re going…

Let’s quickly review the definitions of the four core metrics we’ll be using:

- Strength: Strength is the likelihood that your brand is being discussed in social media. A very simple calculation is used: phrase mentions within the last 24 hours divided by total possible mentions.

- Sentiment: Sentiment is the ratio of mentions that are generally positive to those that are generally negative.

- Passion: Passion is a measure of the likelihood that individuals talking about your brand will do so repeatedly. For example, if you have a small group of very passionate advocates who talk about your products or brand all the time you will have a higher Passion score. Conversely if every mention is written by a different author you will have a lower score.

- Reach: Reach is a measure of the range of influence. It is the number of unique authors referencing your brand divided by the total number of mentions.

These were the perfect signals for this project. I was excited.

This is a snapshot of what a typical keyword search looks like. You’ll notice the strength, sentiment, passion, and reach – as defined above. This is where I started.

Here are the initial sentiment analysis results for an Altcoin called IOTA:

I also have a post about why I think IOTA is set to explode, which you can find on Steemit here.

Pretty cool… I could now see how the market is feeling about any cryptocurrency I wanted.

I then started to think about how I could use this to gain better insight into which ICOs I should invest in.

So… I then started entering the names of each of the ICOs that I was considering buying into social mention, adding them to my spreadsheet – and you’ll be surprised at what I found.

This is how I populated the information into a table:

I first built this… to get all of the data into a single place.

Now I could sort the information by signal, and started to get some interesting insights.

For example, you can start to see coins that are very popular in the social media sphere – and which ones are not.

Why is this important?

This is important because ICOs are largely bought and sold from speculators – folks that think the price of the coin is going to go way up, and that they can simple make some fast cash.

The table above gives insight into which ICOs may be popular – and thus rise in price on launch – due to momentum of it’s base of buys/traders/investors – it’s believers.

I then graphed the information like this:

This made it easier for me to visually see which ICOs had better results compared to those that did not. I could now use this information in any way that I wanted… to extract insight into which ICOs may perform better than others.

The key to the charts are to take all of the core metrics and to correlate which ICOs have the strongest results across all metrics – those are your winners. Those are the ICOs that are likely to pop and go to the moon. It’s that easy and it works.

What is the Ultimate Goal of ICOST?

The ultimate goal of this tool isn’t to guarantee that a particular ICO will launch and be wildly successful. That isn’t the point, nor the promise of this tool.

The goal of this tool is to give you (and initially myself) a better way to sift through the hundreds (and soon to be thousands) of ICOs that are launching each week. There is so much noise in the market, that this is a simple way to separate the winning ICOs from the Losing ICOs. That’s it.

If you apply these techniques with other research on any ICO – you’ll surely find some gems in the pile.

What Does it Cost to Use this Tool?

Nothing! It’s 100% absolutely free for you to use…. I only ask that you give me feedback to improve it.

To use the tool, simply go to CryptoCamacho.com/icost

Also, you’ll like need to purchase Bitcoin in order to fund your ICO investments. My exchange of choice to purchase your first Bitcoin is on Coinbase. When you buy any of those cryptocurrencies using this link, you’ll get $10 free worth of Bitcoin.

If you’ve never used Coinbase, check out my tutorial on how to buy Bitcoin here. I’ll show you how to get started and how to buy your first Bitcoin. It’s all HERE.

In Closing…

If you have never looked into using social sentiment for trading or investing, you should definitely consider it. It’s a powerful way to gain additional insights into invests – that most people have either never heard of or are not using. It’s a relatively new phenomenon that hedge funds and wall street investors are starting to adopt as part of their core strategies.

The good news is that it hasn’t even scratched the surface in the crypto world. The opportunity to use this type of data to analyze cryptocurrencies is enormous.

Hope you enjoyed this post and please leave me questions in the comments!

…and don’t forget to upvote! Thank you!

Resources & Mentions:

- Coinbase: Get $10 Free Bitcoin, Ethereum or Litecoin when you sign up to Coinbase –

- Coinigy: The BEST platform for trading on exchanges from one singe place!

- Changelly: Exchange Cryptocurrency at the best rate

- My Base Trading Tutorial on Youtube

Articles / Mentions:

- ICOtracker.net

- icoalert.com

- coinschedule.com

- topicolist.com

- Stock Prediction Using Twitter Sentiment Analysis

- Stock Trend Prediction using News Sentiment Analysis

- Predicting Stock Market Movement Using Sentiment Analysis

Follow Me:

- My Website: http://www.CryptoCamacho.com/

- Follow me on Steemit: http://www.Cryptocamacho.com/steemit

- My Youtube Channel: https://www.youtube.com/CryptoCamacho

- Join me on Facebook: https://www.facebook.com/crypto.camacho

- Follow me on Twitter: https://twitter.com/cryptocamacho

Enjoy and questions are welcome!

-Crypto Camacho